KFH Rewards

KFH Rewards Prepaid Card is part of the KFH Rewards Program, where customers can earn 10 points for every KD 1 spent when using the card for all purchases, locally and internationally. Moreover, customers will receive 1,000 welcome points upon card issuance.

AlRabeh account

Open AlRabeh account and you will have the chance to win 1,500 Kuwaiti

Dinars weekly,1 kg of Gold monthly and 25,000 Kuwaiti Dinars quarterly.

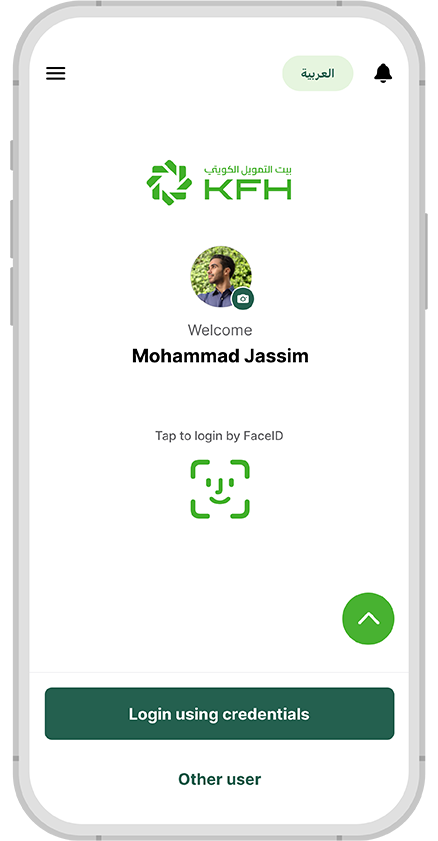

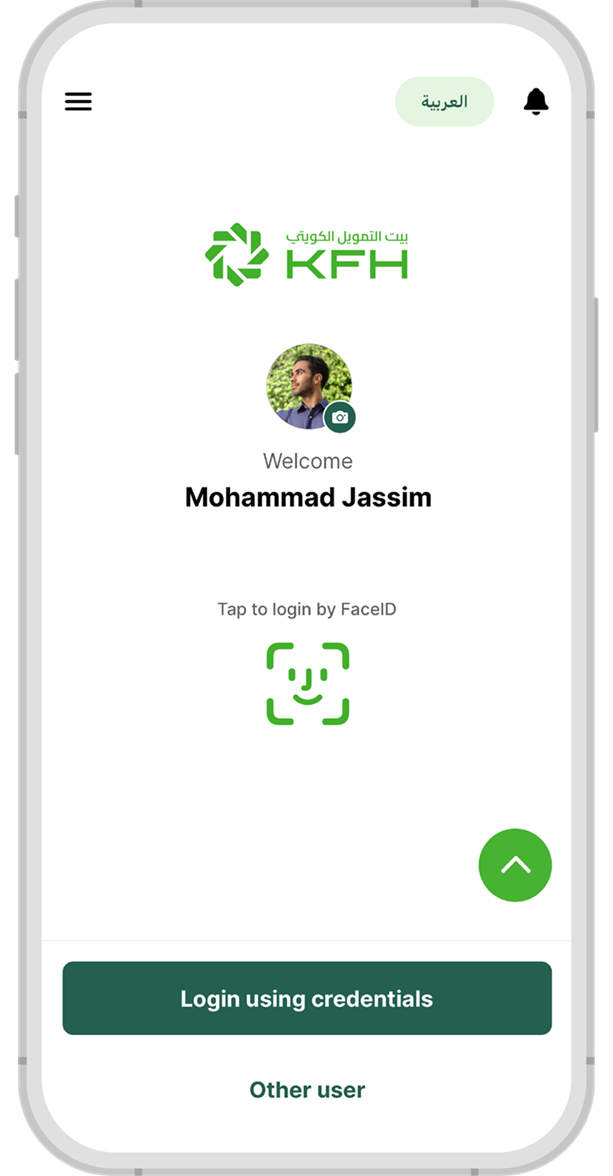

KFHOnline application

- Local & International transfers

- Open accounts and deposits

- Instant virtual cards issuance

- Buy and sell gold

- Cardless withdrawal and deposit

- Send and request money

A collection of services and tools to meet your requirements

In the news..

KFH Reinforces Community Role with Comprehensive “Increase Good Deeds in Ramadan" Campaign

Kuwait Finance House (KFH) has launched its annual Ramadan campaign, “Increase Good Deeds in Ramadan”, comprising a diverse array of social, voluntary, cultural, health, and sporting initiatives. The campaign exemplifies KFH’s ongoing commitment to the community and underscores its leading role in social responsibility. KFH Head of Public Relations and Media, Yousef Abdullah Al-Ruwaieh stated that the campaign’s past successes have turned it into an annual tradition that embodies the values of generosity and solidarity championed by the Bank. He explained that KFH is keen on further developing the campaign every year in collaboration and strategic partnership with the relevant entities. Ramadan Basket (Majla) Al-Ruwaieh explained that the campaign started with the distribution of Ramadan food basket (Ramadan Majla) to families in need, in collaboration with Kuwait Food Bank and Relief, underscoring the Bank’s efforts to strengthen social solidarity during the Holy Month of Ramadan. Iftar Meals He further stated that the Iftar meals initiative continues throughout the month of Ramadan. Thousands of meals, produced in certified central kitchens, are distributed daily to various locations across Kuwait. Volunteering Team He highlighted that KFH’s volunteering team, which consists of bank employees from different departments, is helping to distribute Iftar meals. This reflects teamwork and underscores the significance of social responsibility and volunteerism. Hospitality service at mosques Al-Ruwaieh added that the campaign extends to offering hospitality services at mosques during Taraweeh and Qiyam prayers during Ramadan, serving prayers and strengthening community ties. Quran Competition Al-Ruwaieh highlighted KFH’s commitment to continue organizing the Quran competition, the largest terms of prizes’ value and number of participants. The contest is dedicated to children and the youth from 7 to 18 years of age, and encourages the discovery of talents in Tajweed, recitation and memorization of the Holy Quran. Since its launch 14 years ago, the contest has amassed over 10,000 participants, affirming its significant impact within the community. Another competition for memorizing and reciting the Holy Quran is being held for KFH employees with valuable prizes. The Holy Quarn mobile app He further highlighted the successful application of KFH, the Holy Quran app, which is available on iOS and Android platforms. The app has become one of the major reliable applications, thanks to its exclusive features and user-friendly design. It also undergoes continuous updates that contribute to improving the user’s experience and supporting Quran recitation and memorization. Sports and Health Events Al-Ruwaieh highlighted the Bank's commitment to organizing health and sports events during the Holy Month. Notably, KFH is sponsoring the “FASTING VS CALORIES BY KFH” tournament in cooperation with Levo Club. Held over an entire week, this initiative aims to raise health awareness, promote a culture of balanced nutrition, and create a positive environment that integrates physical activity with health education. Cooking Courses and Healthy Home Nutrition Al-Ruwaieh explained that KFH continues to implement its initiative for female customers and employees. This program features specialized cooking courses led by some of Kuwait’s most renowned chefs, aiming to introduce concepts of healthy home nutrition and encourage better eating habits. Celebrating the Joy of Gergean with Children Al-Ruwaieh emphasized that KFH remains committed to celebrating Gergean with children to help preserve Kuwait’s rich heritage and tradition. This year, the Bank’s outreach includes Sabah Al-Ahmad Cardiac Center, Kuwaiti Society for Guardians of the Disabled, and Kuwait Down Syndrome Society. Events are also scheduled at Al-Shamiya and Al-Khalidiya parks, as well as several public and private schools in partnership with Coded Academy. These efforts aim to bring joy to all children, with a special focus on patients, orphans, and those with special needs. Sharing Iftar Meals with Government Entities Al-Ruwaieh noted that KFH is maintaining its tradition of hosting Iftar meals for public sector employees on duty during the Holy Month. This initiative serves as a token of appreciation for their tireless efforts in ensuring public safety and serving the community around the clock. Daily Social Media Engagement Al-Ruwaieh explained that KFH is utilizing its social media channels throughout the Holy Month to share health awareness videos featuring specialists. This is complemented by awareness messages produced in collaboration with relevant authorities, alongside interactive competitions and comprehensive coverage of the Bank's Ramadan events.

KFH Promotes a Culture of Creativity in the 2025 Innovation Challenge Program

Kuwait Finance House (KFH) concluded its participation in the 10th "Innovation Challenge 2025" program, organized by the Kuwait Foundation for the Advancement of Sciences (KFAS) in partnership with Imperial Executive Education. The program emphasized the importance of teamwork and creative thinking in developing innovative solutions. Learning Journey The four-month program began in Kuwait and concluded at Imperial College Business School in London. KFH team, comprising Noor Al-Essa, Abdulwahab Alkhudhari, Hamad AlAyoubi, and Soud Alnafisi, successfully transformed innovative ideas into practical solutions. Supported by a select group of international academics and experts, these solutions are designed to add real value for customers while enhancing operational efficiency. KFH Acting Group Chief Human Resources and Transformation Officer, Ahmad Alhammad, congratulated KFH team participating in the "Innovation Challenge 2025". He praised their innovative ideas, noting that they reflect the excellence of KFH's young national talent. He highlighted their ability to provide solutions that keep pace with the latest banking technologies, ultimately enhancing work performance and service quality for customers. Alhammad explained that KFH operates with a clear vision to cultivate distinguished future leaders. He emphasized the bank’s commitment to the continuous development and qualification of its employees through an integrated suite of specialized training programs, designed according to rigorous scientific standards. Furthermore, he noted that KFH's exceptional performance indicators reflect the success of its efforts to empower human capital and enhance the capabilities required to achieve its strategic goals. Innovative solution Alhammad praised the Innovation Challenge program for providing a high-caliber platform to hone national talent. He noted its role in building a new generation of leaders capable of transforming creative ideas into practical solutions for real-world professional challenges. He added: "We are pleased with how the "Innovation Challenge 2025" has empowered KFH employees and sharpened their skills". He also highlighted KFH’s eagerness to support KFAS initiatives, which aim to build a robust innovation system that strengthens the private sector and establishes Kuwait as a regional leader in knowledge and creativity. Pioneers of change It is worth noting that the Innovation Challenge program has provided participants with an effective platform to implement ideas, leverage new skills, and integrate them into their professional environments. The program empowers participants to become pioneers of change, fostering the spread of innovation tools and methodologies within their workplaces. In a move to drive institutional transformation, KFAS has partnered with Imperial Executive Education for the tenth "Innovation Challenge 2025". The collaboration aims to strengthen the innovative capacity of Kuwaiti organizations and foster long-term sustainable growth. As a leading national initiative, the Innovation Challenge 2025 uses an applied learning model to help participants solve institutional hurdles. Working alongside world-class faculty from Imperial Executive Education, participants develop strategic solutions that are presented directly to executive leaders at the program’s conclusion.

KFH Group Wins 5 Prestigious Awards from EMEA Finance

Kuwait Finance House (KFH) Group secured five prestigious awards for 2025 from EMEA Finance at the 8th Middle East Banking Awards. The accolades include: Best bank in Kuwait, Best Islamic bank in Kuwait, Best bank for SMEs in the Middle East, Best SME product in the Middle East (Zaheb), and Best Islamic bank in Bahrain. This recognition underscores KFH’s excellence and regional leadership, reflecting its commitment to delivering world-class innovation. Furthermore, it highlights KFH’s dedicated support for the SME sector, a commitment driven by the sector's vital role in maintaining economic stability, fostering national development, and empowering the entrepreneurial spirit of our community. Best Bank Award The "Best Islamic Bank in Kuwait" award reflects KFH’s pioneering financial solutions and its commitment to the highest professional standards, which continue to transform the Islamic finance industry. It also highlights the bank's excellence in launching diverse initiatives that establish KFH as a global benchmark for Islamic banking. KFH’s record profits and leading financial indicators, coupled with its commitment to innovation, digital transformation, and social responsibility, underscore the bank's sustained trajectory of success. These awards further validate KFH’s dedication to its core values as it continues to solidify its position as a premier global Islamic financial institution. Best bank for SMEs KFH Group Chief Corporate Banking Officer, Yousef Almutawa said that being named "Best Bank for SMEs" and "Best SME Product" in the Middle East reflects KFH’s excellence in supporting Kuwait’s SME sector. By offering integrated financing solutions, such as Murabaha, Ijara, and Tawarruq, alongside advanced digital services, KFH remains a pioneer in the industry. As the first bank to establish a specialized SME department, KFH continues to empower businesses through financial advisory and training, driving both sustainability and digital transformation to strengthen the local economy. He revealed that KFH`s eCorp platform for corporate customers has witnessed a remarkable increase in usage following the launch of its upgraded e-services and mobile app. The platform provides an exceptional banking experience tailored specifically for the corporate sector." KFH has introduced a new suite of digital services designed to enhance user flexibility. These include full-authority individual accounts, electronic update of data, and "Zaheb" payment service. Additionally, users can now issue QR-verified IBAN certificates, access details of existing credit facilities, request new credit facilities, view transaction details, request new transactions, and process outstanding payments," Almutawa explained. He added that the newly updated platform offers a wide array of services, ranging from salary transfers and chequebook requests to viewing account statements, tracking interbank transfers, and managing user permissions within a multi-registration system. Furthermore, the platform offers a comprehensive suite of services, including standing order management, monthly statement subscriptions, and automated coverage services. Users can also issue balance verification certificates, reactivate dormant accounts, and execute transfers at direct rates (360T). Additionally, the platform supports clearing company distribution subscriptions, the opening of new investment accounts and deposits, and the issuance of remittances, letters of credit, and guarantees. Other features include drawdowns from existing credit facilities, "Zaheb" payments, all types of transfers, beneficiary management (local and international), lost card reporting, and IBAN sharing. He added that KFH plays a major role and provides SMEs with a range of services. These include cash financing, various types of letters of credit and letters of guarantee, advanced digital support, offering corporate customers with POS services, dedicated mobile app that facilitate the management of the businesses’ accounts including, payroll transfer, view performance reports. “KFH also supports training and sustainability. In this regard, the Bank launched the Growing Sustainably Training Program in cooperation with the UNDP to support sustainable business practices. In addition, KFH’s role goes beyond financing businesses, its efforts extend to strategic partnerships, advisory and the exchange of expertise to promote the growth of businesses.” Speaking at the awards ceremony in Dubai, Deputy General Manager Global Markets Trading and Investments at KFH, Khalid AlRukhayes stated: "We are delighted to receive these five prestigious awards from EMEA Finance. This recognition underscores KFH’s leadership and our steadfast commitment to delivering innovative financial solutions that meet customer expectations while adhering to the highest international standards." He added: “These awards also reflect outstanding achievements in delivering services, products, and initiatives that create tangible value for the Group’s communities, including SMEs. Combined with high-quality operations and a diverse customer base, KFH has successfully consolidated its position as a trusted partner to both its customers and the wider community." The EMEA Finance Middle East Banking Awards celebrate the region's most outstanding achievements in financial services. Now in its 18th edition, the program continues to draw participation from the Middle East’s most prestigious financial institutions. As some of the most esteemed honors in the regional banking industry, the EMEA Finance Awards recognize institutions that demonstrate exceptional financial performance, service quality, and industry leadership. In selecting winners, the prestigious financial group evaluates key metrics including market share, product growth, and profitability, alongside the strength of a bank’s business strategy, industry contributions, issuance market presence, and innovation in products and services.

KFH Organizes the Quran Memorization and Recitation Competition

Kuwait Finance House (KFH) has announced the launch of its 14th annual Quran Memorization and Recitation Competition, dedicated to children and youth, and the receiving of applications for those wishing to participate during the Holy Month of Ramadan. The contest affirms KFH’s social role and its keenness to promote Islamic values within the community, in addition to encouraging individual to recite and memorize the Holy Quran. Executive Manager Social Media and PR Services Center at KFH, Abdullah Al-Saif, said that the contest encourages the discovery of talents in Tajweed, recitation, and memorization of the Holy Quran. “It motivates the current generation to read and memorize the Holy Quran, while also clarifying some of the rules of Tajweed.” He also noted that the contest will be broadcast on KFH's social media channels with extensive media coverage from various outlets. He added: “Having been launched 14 years ago, the contest is the oldest and the largest of its kind in Kuwait in terms of prizes value, with over 10,000 participants so far. It is part of KFH’s integrated Ramdan program, demonstrating the Bank’s commitment to its social responsibilities and aligning with the core values of Ramadan, a time for Quranic reflection and recitation.” Al-Saif further noted that registration for the contest will be available through several modern digital channels to facilitate participation and accommodate the recurring high annual demand. Participants will be categorized into age groups, and according to recitation and memorization sections. He pointed out that the contest has earned growing trust among Quran reciters year after year, supported by appreciation for KFH as the first bank to initiate such initiative, in addition to the presence of several valuable elements that enhance competitiveness and motivate participants. These include a distinguished judging panel of esteemed scholars, as well as well-structured organization tailored to the varying abilities, age groups, and recitation levels. Al-Saif revealed that the contest is organized separately for male and female participants. “It includes awards for approximately 40 winners, with prizes distributed to those selected from among the applicants at the conclusion of the contest. Participants will memorize or recite specific verses from designated sections, as determined by the judging panel.” Another contest is being held for KFH employees, with valuable prizes for 30 winners, as clarified by Al-Saif. Further to Iftar campaigns and mosque hospitality to sports events, public engagement, and Iftar meals distribution, KFH's Increase Good Deeds in Ramadan program offers a diverse range of community initiatives, showcasing its dedication to social responsibility. The program also encompasses daily competitions, Gergean events, awareness videos and sharing Iftar with many entities that perform their duty during Iftar time, as well as distributing Ramadan Basket, affirming KFH's leadership in social responsibility.

Germany

Germany Malaysia

Malaysia Turkey

Turkey Egypt

Egypt UK

UK Kingdom of Bahrain

Kingdom of Bahrain